blog

10 Questions To Ask A Realtor Before Hiring Them

With so many real estate agents out there, the upfront process can be confusing. You might have a friend, family member or have seen a sign in a yard for sale but, how do you pick an agent and what questions should you be asking. The key to saving thousands of dollars comes from picking…

Read MoreCredit Tips Before and During The Mortgage Loan Process

When starting the pre-approval process, you should not do anything that will have an adverse effect on your loan from this point through your closing date. It may be tempting to start opening credit cards for furniture and other miscellaneous items, but this is the time to keep your financial picture frozen in a stable…

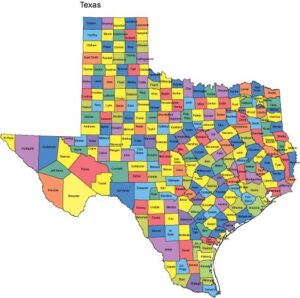

Read MoreBest Texas Mortgage Lender in 2019

How do you find the best texas mortgage lender in 2019? Depending on what your goals are lets review somethings to think about when trying to figure out which mortgage lender is right for you. With so many options and interest rates on the internet how do you know who to trust and if your…

Read MoreHouston Home Loan | Texas Premier Mortgage

Mortgage Approval Process Houston Home Loan | Texas Premier Mortgage Houston Home Loan. #1 Rated Houston Home Loan Lender. Texas Premier Mortgage is a local Houston mortgage company. We offer experience and local knowledge to get you the lowest rates and fees. Call us today to experience our Award Winning Service. 281-627-4222 Whether you’re a…

Read MoreMortgage Closing Costs

In addition to the basic mortgage underwriting, processing and origination fees that are charged by a lender, there are several other costs associated with purchasing a new property. Since every player on your real estate home buying team has a stake in your transaction, it’s a good idea to know how to budget for their…

Read MoreRenting vs Buying A Home

Renting vs Buying a Home is a big decision that takes careful consideration. While there are several biased sources that can make arguments for or against owning a home, we’ve found that most home buyers base their ultimate decision on emotion. Yes, there are some tax advantages of owning real estate, as well as the…

Read MoreReasons to Refinance Your Mortgage

A mortgage is generally the largest debt most homeowners have to manage. It’s a good idea to give your personal real estate finance portfolio a check-up at least once a year. Since there are many reasons a homeowner may choose to refinance, we’ll take a look at the four most common. 1. Mortgage Rates Drop:…

Read MoreMortgage Terms To Know

While most mortgage web sites offer a glossary containing hundreds of real estate and lending related terms, we wanted to highlight the top terms that most borrowers will hear several times throughout the approval and home buying process. Understanding the “Shop Talk” between the various industry professionals that you’ve assembled on your team will hopefully…

Read MoreCommon Documents Required For A Mortgage Pre-Approval

Even though many lenders are still quoting quick 10 minute pre-qualifications over the phone or online, a true mortgage approval that holds any weight is one that has been issued by an underwriter who has had an opportunity to review all of the necessary documents. With a constant stream of new lending guidelines, volatile mortgage…

Read MoreFirst-Time Home Buyer Credit Checklist

Getting a new mortgage for a First-Time Home Buyer can be a little overwhelming with all of the important details, guidelines and potential speed bumps. Since there are so many rules and steps to follow, here is a simple list of Do’s and Don’ts to keep in mind throughout the mortgage approval process: DO: •…

Read More